Budget reconciliation negotiations among Democrats have hit an impasse over Senator Joe Manchin’s worries about extending the Child Tax Credit (CTC) without a work requirement. As he put it in his agreement with Majority Leader Chuck Schumer, Manchin believes any new family spending must have “needs based means testing.”

At the outset, it is worth emphasizing that Manchin’s position is not entirely unreasonable. While America is one of the few developed nations without a child allowance — a 2020 survey found 108 countries have some form of periodic child benefit anchored in national legislation — the concept is nonetheless somewhat novel in the U.S. context. It is therefore worth reviewing the top five reasons why adding a work requirement to the CTC is not only unnecessary, but may even risk undermining Manchin’s own stated goals.

1) The work disincentives from child benefits are negligible

Unconditional child benefits have historically faced an uphill battle in the U.S. given concerns over the potential that they disincentive work. As recently as the 2016 election, then-candidate Hillary Clinton proposed a significant CTC expansion that still phased in with earnings. This was simply following the conventional wisdom that her husband established 20 years earlier with welfare reform: namely, that transfer programs should always be tied to work, implicitly or explicitly, in order to promote self-sufficiency and thus genuine poverty alleviation.

In the decades since, however, anti-poverty experts have realized that we in many ways over-learned the 1996 welfare reform’s success at promoting work among single mothers. After all, the Clinton-era welfare reform was aimed at Aid to Families with Dependent Children (AFDC), a program that not only provided cash assistance to needy families, but one which also rapidly withdrew assistance if a struggling parent sought employment. As a textbook example of a poverty trap, AFDC’s steep benefit cliffs promoted dependency by design. This was technically the byproduct of too much means-testing, not too little, made all the worse by Kafkaesque social services that sacrificed the poor on the altar of bureaucracy.

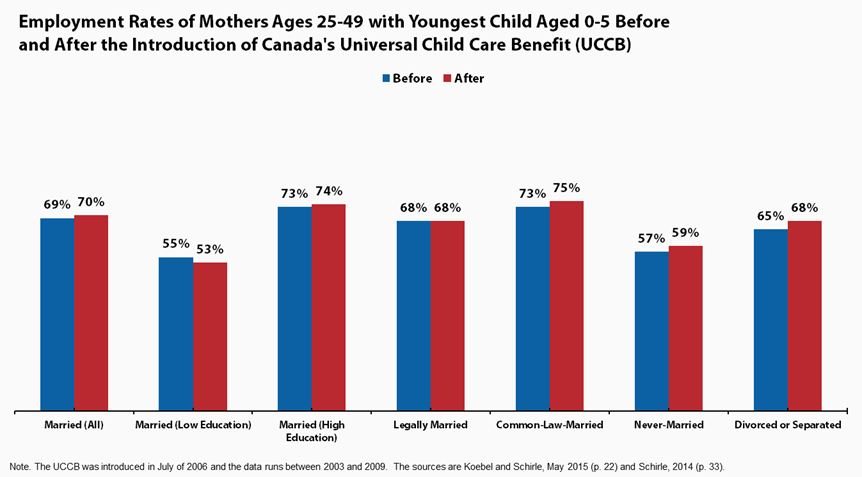

Flat child benefits don’t suffer from AFDC’s benefit-cliff problem, as a dollar earned is a dollar kept. Meanwhile, the disincentive from the pure “income effect” of a child allowance ranges from small to negligible, and in a way that is differential with respect to married and single mothers (no study has ever found a significant effect on the labor supply of fathers). Canada’s child benefit is nearly twice as large as the CTC expansion being considered by Congress, and yet a 2021 study found no overall effect of its expansion on overall parental labor supply. To the extent employment rates were affected at all, earlier research found the Canada child benefit only decreased work among a small subset of married mothers who became stay-at-home parents. Never-married parents, meanwhile, increased their employment rate by nearly 2 percentage points.

The Canadian results are consistent with the broader research literature on income effects. While one must always be cautious with international comparisons, the labor market institutions of countries like Canada, Australia, and the U.K. are far more similar to the U.S. than their counterparts in Northern Europe. In fact, a 2020 study of the CTC found that a $1,000 increase in the credit was associated with a 1.1 percentage point increase in the labor force participation of single mothers — exactly in line with the Canadian results. In both studies, the effect was driven by single parents who used the child benefit to afford home- and family-based child care.

2) The “zero-income” demographic is not a bunch of slackers

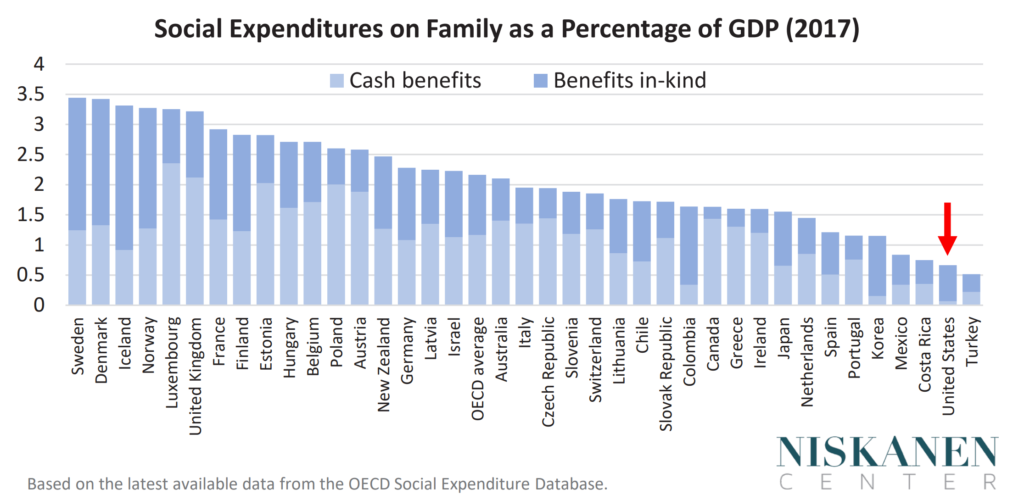

Most rich countries have a child allowance in recognition that child dependents add expenses for households without generating any corresponding income. While promoting work is important to reducing poverty, the market does not automatically pay workers more simply because they have kids at home. That basic arithmetic is why child benefits are essential to reducing overall rates of family poverty, as illustrated by the United States’ outlier status among the OECD in terms of both child poverty and social spending on family.

Nevertheless, some remain squeamish about providing a cash benefit to households with low or zero income. The image in the critic’s mind is a member of the non-working poor — what scholars in the 1990s called the “underclass.” Yet this portrait of households with zero reported income is as outdated as it is misleading. Income distributions are not static; people move in and out of “poverty” as measured by income every year. Nor does reporting zero personal income in a given year imply that one is necessarily poor. It’s not uncommon for a small business owner with some savings to forgo taking a salary until their company gets off the ground, for instance.

The 2020 Census found that 5.8 million children in the U.S. live in households headed by their grandparents, or 7.9 percent of all children under the age of 18. In addition, over 4 million U.S. households with children are headed by parents with a disability. Parents and legal guardians living on a fixed income typically don’t need to file a tax return, and when they do, Social Security benefits are not considered part of their gross income. Nonetheless, these households face all the same child-related expenses as households with working-age parents. And while Social Security offers “auxiliary benefits” to beneficiaries with child dependents, restrictive rules mean that more than half of all families with two or more beneficiaries are affected by the statute’s per-family maximums. The “dependent allowances” in state Unemployment Insurance programs are even more paltry, averaging on the order of $5 extra dollars a week per child.

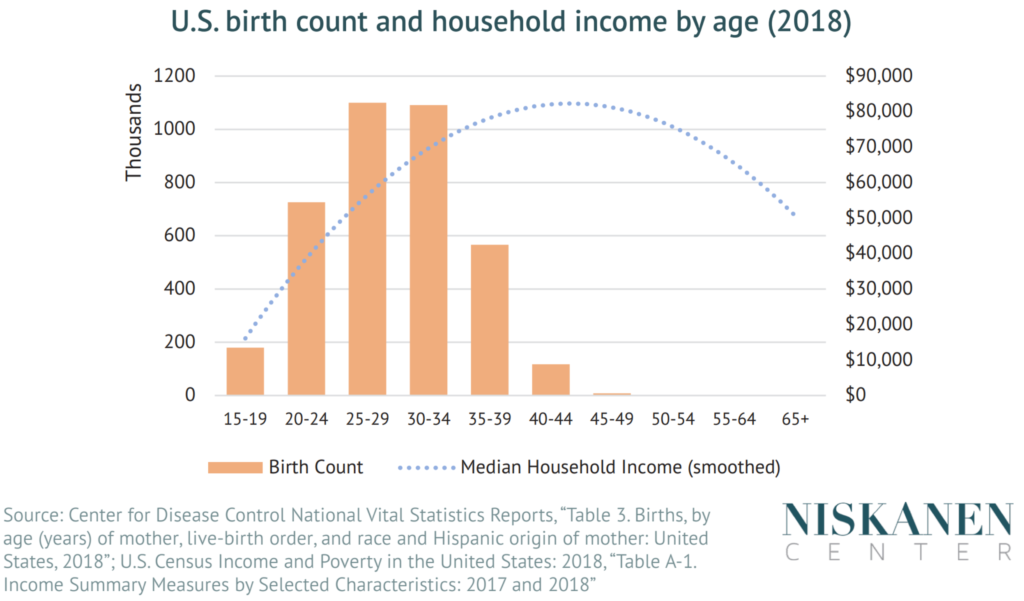

The age gap between when a family has their first child and when they reach their peak earning potential makes tying the CTC to tax liability particularly problematic. That’s all the more true for parents young enough to still be in school. According to 2015-2016 data from the National Postsecondary Student Aid Study, 22 percent of all undergraduates in the U.S. are parents. This represents 3.8 million students raising a child while in college, typically with minimal market incomes and large additional expenses like tuition. Not surprisingly, with the share of colleges that provide on-site child care services in steady decline, the dropout rate among student-parents is the highest of any demographic. If the goal is long-term self-sufficiency, using the CTC to incentivize cash-strapped parents to quit school in favor of an entry level job is misguided to say the least.

3) More rules mean more bureaucracy

Even a modest earnings requirement would severely compromise the administrative simplicity of the Child Tax Credit. As it stands, the IRS has made strides toward easing the application process since the CTC was temporarily extended in 2019, including through a simplified online portal. The lack of a phase-in under the extended CTC has been critical to this effort. With benefit calculations now a matter of simply counting the number of eligible children in a household, the administrative burdens involved with income verification have been lifted.

Contrast this with the Earned Income Tax Credit (EITC), which has a complex phase-in structure and 41 pages of tax preparation rules. It is no wonder that the EITC suffers from such a high error rate, accounting for 44 percent of all IRS audits in 2019. These mispayments are a pittance compared to the estimated revenue the IRS fails to collect from wealthy individuals every year, and place significant stresses on both the recipients and the IRS itself.

As my colleague Brink Lindsey and I put it in our agenda paper, Faster Growth, Fairer Growth,

Wherever possible, we need to maintain a dogged preference for simple, clear rules and standards over multifactor balancing tests; for big, blunt interventions over subtle nudges; for on-budget direct payments to beneficiaries over tax preferences and empowering bureaucratic intermediaries; and for decision-making venues that force rent-seeking insiders to face effective representation of the broader public. Small government is not the answer; what is needed is simpler, more legible government.

A child allowance fits that bill. By not phasing out until relatively high incomes, the CTC now reaches 96 percent of all families, with benefit levels that only need to be adjusted for households that file income taxes anyway. The simplicity of a flat benefit reduces the need for bureaucracy, leaving paternalism to parents. It has also made it infinitely easier to enact important policy innovations, from making the credit a monthly payment, to allowing the credit to follow a child who lives part of the year in a different household. This would all be jeopardized by even a modest work requirement.

4) Earning phase-ins amplify income shocks

Even if a flat child benefit doesn’t discourage parents from working, some still support phasing the Child Tax Credit in with earnings as a proactive work incentive. For non-working, able-bodied parents, the credit’s historical 15 percent phase-in rate may function as a kind of wage subsidy: with every dollar earned along the phase-in range, the CTC kicks in an extra 15 cents.

This argument suffers from several problems. First, most labor market entry decisions are relatively binary — do you take the entry-level job or not — and therefore unlikely to be influenced by marginal incentives at very low levels of earnings. Indeed, even the EITC’s effectiveness as a work incentive is now under dispute despite its far more aggressive phase-in rate of 34 to 45 percent.

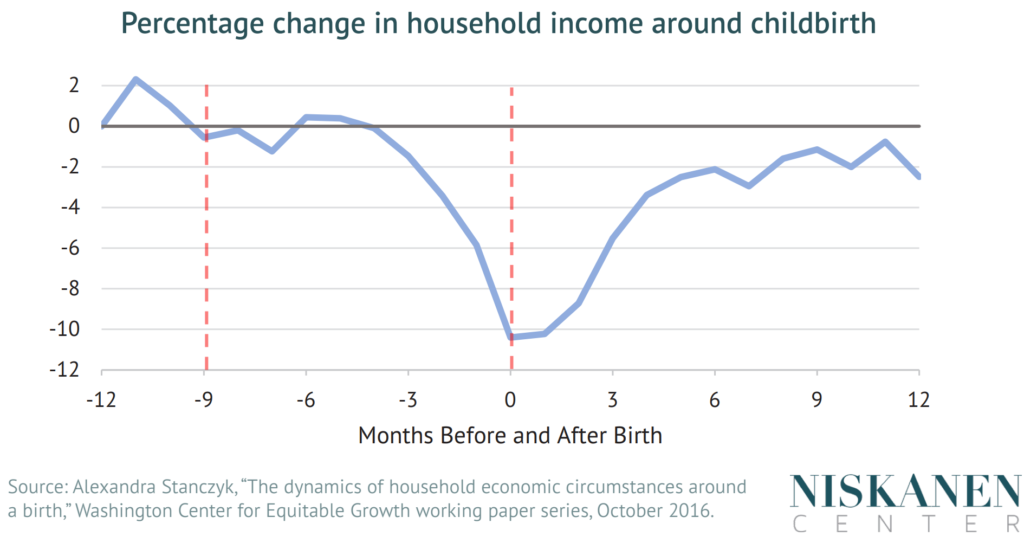

Less appreciated is how an earnings phase-in can wind up amplifying income shocks if and when they occur. Consider a single parent who takes a year off work to care for a sick family member. While this parent may normally earn a reasonable wage, they will report low or zero income within the period of their leave. If the CTC is phased in with annual earnings, any loss of market income that results will come with an additional reduction in tax benefits, turning the social insurance function of the CTC on its head.

The perverse flipside of a CTC earnings test should be particularly troublesome to pro-family conservatives. The certainty and predictability of an unconditional child benefit is key to promoting household stability, as measured by rates of divorce, reductions in child abuse and neglect, and lower consumption of stress-relievers like alcohol and tobacco.

5) Child allowances reduce dependency and social inequality

Pregnancy and childbirth can itself represent a significant income shock. The nation’s traditional welfare system, Temporary Assistance for Needy Families (TANF), is thus widely acknowledged to function as a kind of maternity-leave-of-last-resort for new moms near the poverty line. In lieu of a child allowance, cash-strapped new parents are instead forced to turn to means-tested public assistance.

The unconditionality of a child allowance can help divert these parents from sticky, bureaucratic forms of aid in a way analogous to how Unemployment Insurance diverts dislocated workers from turning to disability insurance. Child allowances can thus promote improved social mobility in the long run, all while reinforcing a deeper commitment to social equality. As I put it in a piece for the Institute for Family Studies earlier this year,

At 22.9% of all “poverty spells,” the introduction of a new child to the family is the third leading reason women report turning to traditional welfare programs. Divorced and never-married mothers are particularly vulnerable in this respect, including those who may have otherwise considered terminating their pregnancy, giving rise to the so-called “feminization of poverty.” In lieu of a simple child allowance, many cash-strapped moms are thus forced to turn to more bureaucratic alternatives. Navigating the morass of Great Society-era anti-poverty programs can itself become a full-time job. As a result, a family that starts off as merely income poor risks becoming socialized into “poverty” in the richer sense of the term, putting children at a much higher risk of becoming dependent as adults.

Senator Manchin’s concerns about the potential for family welfare policies to backfire and create dependency are thus not without merit. Well-intentioned policymakers in the U.S. have a long track record of doing just that. Nevertheless, if the senator paused to take a closer look at the evidence around child allowances, he might well be surprised. Far from repeating previous policy mistakes, the CTC expansion in the reconciliation package would actually right those past wrongs, creating a more equitable and family-friendly tax code in the process.

Samuel Hammond is the director of poverty and welfare policy at the Niskanen Center, and co-author of The Conservative Case for a Child Allowance.

"work" - Google News

October 02, 2021 at 03:48AM

https://ift.tt/3l2ZPVo

Five Reasons the Child Tax Credit Shouldn't Have a Work Requirement - Niskanen Center

"work" - Google News

https://ift.tt/3bUEaYA

Bagikan Berita Ini

0 Response to "Five Reasons the Child Tax Credit Shouldn't Have a Work Requirement - Niskanen Center"

Post a Comment