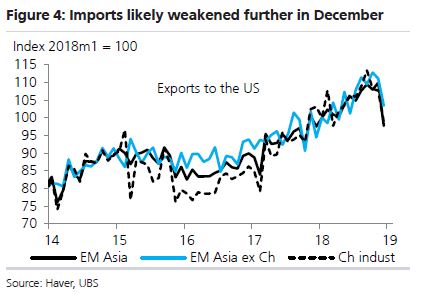

With little apparent progress in U.S.-China trade talks, the Trump administration could be about to open up a new front in the trade wars by taking on the European auto industry — and that could spook markets. U.S. negotiators head to China next week, and while there are few signs any kind of deal is near, many strategists expect to see some signs that talks will continue and an eventual agreement will be reached, even if a March 1 deadline on new tariffs is pushed back. But while the market has focused on those talks, another battle is brewing. The Commerce Department by Feb. 17 is expected to release a broad report on auto imports and national security, and experts say a part of that report could recommend tariffs on European autos. The White House would then have 90 days to respond. Dan Clifton, head of policy research at Strategas, said Trump could be using the threat of auto tariffs as a way to get the EU to cooperate on other matters. The EU has been resisting efforts to include U.S. agriculture in a trade deal. "Just because there's a report does not mean tariffs will go into effect," he notes. But some economists expect the administration to move on the auto tariffs, specifically on European cars. For instance, UBS economists said they expect 25 percent tariffs to be placed on finished vehicles, not parts. The administration then could grant exemptions to other countries that have cooperated, like Korea, Canada and Mexico, but the European Union would not be exempted. "It just seems like if people had been worried about the tariff war with China, this would be another reason for people to worry. In our view, this is not a macro event for the U.S. because the auto industry seems to be pretty tariff savvy and can get around them," said Seth Carpenter, chief U.S. economist at UBS. Some strategists fear investors are keenly focused on China, and expect a resolution, but could be surprised by ramped-up trade friction with Europe. "The market would tank," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "The market has spoken loud and clear that it's had enough of these tariffs. ... The market is fed up with this. Global growth is slowing dramatically because of trade. You want to put another bullet in it's head?" Stocks sold off Thursday after top White House economic advisor Larry Kudlow said the differences between the U.S. and China are still "pretty sizable." The market also became nervous after reports that there is no meeting now planned now between President Donald Trump and China President Xi Jinping, ahead of the March deadline. "What matters most are whether the tariffs are going up on March 1, and there's some confusion about that," said Clifton of Strategas. Clifton said he expects the tariffs to be delayed if discussions are ongoing and an agreement will ultimately be reached. "The market started pricing some very high expectations," he said, adding that the Trump administration may intentionally be tamping down expectations. "If next week's talks go well, I would not be surprised to see [a Trump, Xi meeting] gets put on the calendar." Adding to concerns about China, Trump could soon issue an executive order banning Huawei equipment, according to Politico. The U.S. alleges the Chinese telecom company has been conducting cyberintrusions and in January, the Justice Department filed charges against the company and its CFO, who has been arrested in Canada. U.S. Trade Representiative Robert Lighthizer and Treasury Secretary Steven Mnuchin will attend the next round of talks, and the U.S. is seeking a round following that. The emphasis is expected to be on enforcement and changes in policy by China on things like intellectual property. "Next week is a very big week. Lighthizer is clearly a hawk," said Tom Block, Washington strategist at Fundstrat. He said it will be important to see a positive tone after the meeting, as none of the other sessions have been downbeat. "They gave a good cop, bad cop team going over there. It will be very important how that communique comes out after the meeting." Economists believe the U.S. and China will ultimately come together because the trade war is hurting both countries. November trade data showed the U.S. trade deficit narrowed sharply. Both imports and exports declined but the drop-off in imports was larger. "That showed a sharp drop in imports of 3.6 percent month on month. That's a big drop. We also got trade data for Asian exports to the U.S. for December. Asian exports to the U.S. in December were down 10 percent," said Carpenter. "I do think trade matters ... when you start to affect the U.S. and China, you're by definition talking about a global phenomena. The U.S. economy is big. The Chinese economy is big. Put them together, and it has to register on a global scale."

Source: UBS Block said there's a fog of trade issues currently, and even though he expects a deal, the outcome with China is still uncertain. He also notes that the reworked trade agreement with Canada and Mexico is not adopted yet, with both Republicans and Democrats in Congress seeking changes. "There's bilateral negotiations going on with Japan. ... There's negotiations going on with the EU. There's a lot of moving pieces on trade, and [Trump] set up, with his bluster, a lot of key points coming up, and I don't think anyone knows where they're going. There's a lot of murkiness with the whole trade picture," said Block. Strategists expect if the Commerce Department does move on auto tariffs, the administration would wait to respond until after it has a deal with China. "We think China has shown some willingness to make some concessions," said Citigroup economist Cesar Rojas. "For example, on IP protection, in a different forum, the government has pledged more strict protection. ... There has also been some news suggesting they will push for legislation on core technology theft." Rojas said the sticking point will be in the details and whether China follows through and whether the U.S. can be satisfied with enforcement. "If there is a positive tone, then our expectation is there could be a roll over of the deadline in recognition of progress in the negotiations, and therefore the trade representative would move forward. If the tone is not positive then that would hint at the potential escalation, but still we are about two more weeks ahead of that deadline," Rojas said. If the Commerce Department proposes tariffs on European autos, it would not be a surprise, given Trump's criticism of German luxury vehicles in the U.S. despite the fact that BMW and Daimler are also U.S. manufacturers. "We expect the report will recommend tariffs," said Rojas. "The administration is likely to push for trade talks. ... What we're seeing are signs of a slowdown in the European economy ... to come up with this threat of additional tariffs when they were relatively weak gives the U.S. additional leverage."

Let's block ads! (Why?)

via World - World Indonesia - Google News https://cnb.cx/2DgEMra |

0 Response to "Trade war headlines could get much worse before they get better as the US looks to Europe - CNBC"

Post a Comment